Contents:

Automation and its role in recruitment is somewhat typical of automation in accounting altogether. In the early stages there was scepticism, technological advancement was seen as an emerging threat to the industry. Now it’s seen as a clear indicator on whether a firm is willing to evolve. Those that do, have a far better chance of navigating the recruitment problem. Some studies seem to highlight the importance of gut-level business decisions, but no choice is made without data.

Create Purchase Order requisitions for goods and services to speed up the buying process. Streamline your entire invoice process while matching your current approval workflows. Stay one step ahead with bite-sized business insights from the Smith School’s world-class faculty. “The accounting profession is actually getting more interesting, if anything,” says Hann, the Dean’s Professor of Accounting at the University of Maryland’s Robert H. Smith School of Business. With regards to technical dependency, possibly, but there are alternatives you can always jump to. For compliance, you can look at their security precautions and come to your own conclusions regarding your own appetite for risk.

Building on all these financial analyst opportunities, you will have more time to add value and insights to strengthen your company’s internal controls. From a performance standpoint, with accountingautomated, you will be able to check your company’s key performance indicators, see if those goals are being achieved and adjust to make sure they are. By answering these questions, you will be contributing to the growth and strategic positioning of your company and providing insights to managers and departments across the business.

Automation Won’t Be Replacing CPAs—It Will Enhance Their Work

Most accounting workflows start with identifying transactions, then recording them. As you know, this is a not-so-glamorous stage of the accounting cycle. But also proactive in ensuring clients send on the relevant paperwork. It’s worth acknowledging one area where this debate has rumbled on. As we’re sure you know, recruitment is an ongoing issue for some firms.

Research using semi-structured interviews with a convenient sample of Lebanese employees, employers, instructors and students who were willing to participate and offer their insights. For that purpose, a literature review is first conducted to build the theoretical platform followed by pinpointing what researchers have contended about the impact of automation. When setting up workflow automation, companies must first consider their needs and goals.

What is automated accounting system?

With automation, you can track their business income, expenses and sales far more efficiently. This kind of technology also creates reports which detail any potential liabilities. Those deadlines can be client related, like VAT returns or self-assessments.

Accounting automation software helps automate mundane clerical tasks, thus helping you save on costs. Automation can process more records in less time and at a lower cost. When using accounting software, you do not require to invest in a large accounting team to complete transactions.

13 Best Project Management Software in 2023 – CBS 6 News Richmond WTVR

13 Best Project Management Software in 2023.

Posted: Fri, 21 Apr 2023 15:19:08 GMT [source]

Machine learning AI is becoming more widely available in many business software tools. This level of AI is used mainly to understand consumer markets better. For business owners, the reliance on accountants is reduced to an extent as the data is presented in an understandable form with just a few clicks. The scope of traditional accountants gets limited as digital spreadsheets are transformed into various reports and charts with just a few clicks. Business owners can customize the reports as per their needs and brings better insights.

Better insights and analysis

In your internal controls audit role, you could be called upon to fix poor record-keeping or other aspects of your financials that add risk to your business. You will be relied upon to help your company avoid attracting interest from outside auditors. Your financial insights will give you access to information about your liabilities and how you manage your cash flow. “Firms have always wanted auditors to have financial skills, but we see a significant increase over time in the demand for cognitive and social skills,” Hann says. Let’s get this out of the way—CPAs will not be replaced by automation.

50-year-old Nashua sets sights on AI, energy and cloud – ITWeb

50-year-old Nashua sets sights on AI, energy and cloud.

Posted: Fri, 21 Apr 2023 09:27:14 GMT [source]

Founded in 1909, the California Society of Certified Public Accountants is the largest statewide professional association of certified public accountants in the United States. CalCPA offers a wide variety of benefits and services for CPAs and financial professionals. CalCPA, with 14 chapters located throughout the state, is committed to the education and betterment of our members and the profession. The most advanced AI technology that makes computers pseudo-cognizant of their tasks, called deep learning, rests at the very bottom of the well. This level of automation is still being studied and is unlikely to come to the financial sector any time soon.

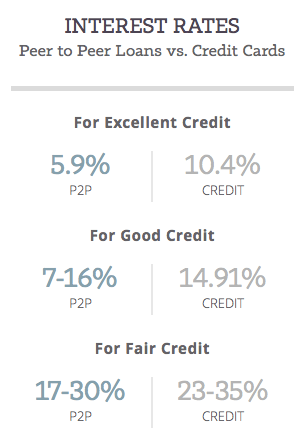

Credit Risk Management Software

It’s important to ask why, out of all industries, finance faces such a high level of potential automation. As you well know, much of the day-to-day work in accounting and bookkeeping is systematic. There are processes within processes, and tasks that form a much larger output of work. At Dext, we are firm believers that accounting automation is a step in the right direction for the industry and its people. But we also understand there’s uncertainty and questions that need answering. Here, we want to address those and share why accounting technology is a must-have for firms.

Integrating this kind of technology not only helps businesses stay abreast of the latest trends, but it also allows them to scale up and serve their clients better. While there are many firms yet to adopt technology, that may all change soon. The rise of digital commerce is a seismic trend that spans more than accounting alone. Changes to consumer behaviour have forced businesses to adapt how they operate. An example of this is point-of-sale systems that we now pay through when in store.

Business process automation is a foregone conclusion when it comes to new-age businesses. From physical robotic processes to data recording to decision-making systems and predictive analysis, automation is evolving in its capabilities and application. Compiling employee expenses reports can be exceptionally manual and error-prone if you’re handling these accounting processes the old school way with spreadsheets.

Automation Does the Work Accountants No Longer Want To

Accounting and auditing have immensely benefitted from automated data recording that has enabled higher accuracy and completeness of record-keeping. Cloud-based accounting software has provided hassle-fee accounting, thereby saving time from manual data entry and reducing the scope of data recording errors. With these upcoming technologies, the complex procedure of accounting has not only been made easier but also a lot of time can be saved during the whole process.

The insights that automated reporting provides can also introduce angles that a human mind might not necessarily be able to predict. The reporting is also always ready to be passed onto the auditing team. Using automation programs for tedious bookkeeping duties helps keep accounting records updated, minimizes errors in data entry for accounts receivables and payables, and expedites the overall accounting process. Furthermore, the configuration in accounting software keeps financial records aligned with established principles.

Accountants and financial professionals use Artificial Intelligence and various Application Programming Interfaces to simplify their work and automate repetitive tasks. According to Gartner, the implementation of RPA can easily save an accounting team of 40 people around 25,000 hours of costly rework caused by human error every year. Automated accounting uses software and programs to complete various accounting tasks, such as bank reconciliations. However, over recent years, automation has considerably increased and improved the functionality of these programs. Once accountants shift into this mindset, the value proposition of the accounting firm revolves around the human touch—and that makes for more rewarding work. While accountants will not be completely replaced by technology, roles and relationships will change—in a good way.

- The rise of digital commerce is a seismic trend that spans more than accounting alone.

- I think many of the responses here are confusing book-keeping with accounting.

- The software also integrates international payment systems and updates bank records resulting in quick bank reconciliation and that too, with one hundred percent accuracy.

Whether you’re recording fob shipping point, posting them to your general ledger or creating financial statements, you can leverage automation to help streamline the complete workflow and make your work more productive. We’ll be taking a deeper look at the accounting cycle and automation later on. Were better-paid, better-educated workers in technical and supervisory roles, with men, white and Asian-American workers, and midcareer professionals being some of the most endangered.