Content

The cycle incorporates all the company’s accounts, including T-accounts, credits, debits, journal entries, financial statements and book closing. To create an unadjusted trial balance, list all general ledger account balances before adjusting entries for your financial statement. You can use the trial balance to create basic financial statements without sorting through the general ledger.

What is the accounting cycle?

An accounting cycle is a process of recording, identifying, and analyzing accounting events and activities for a particular accounting period. This accounting period could be monthly, quarterly, annual, or for any specific period. A bookkeeper or accountant takes the responsibility to make proper entries and keep the accounting information accurate.

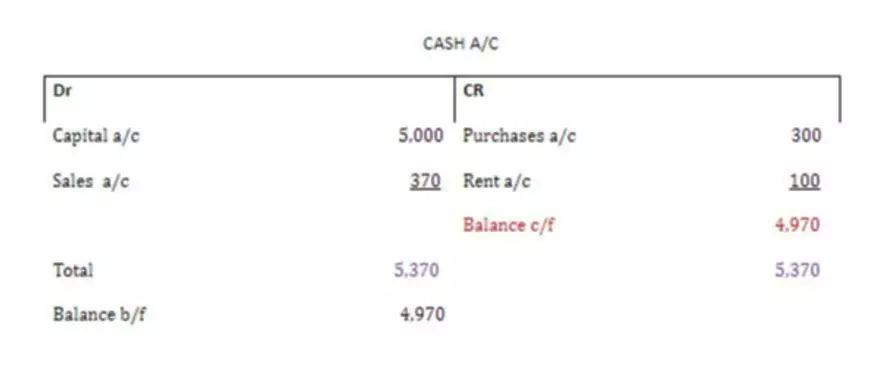

An example of an account in the general ledger is the cash account which shows the total inflows and outflows relating to that account during an accounting period. The accounting cycle is a set of steps that are repeated in the same order every period. The culmination of these steps is the preparation of financial statements. Some companies prepare financial statements on a quarterly basis whereas other companies prepare them annually. This means that quarterly companies complete one entire accounting cycle every three months while annual companies only complete one accounting cycle per year. CPA firms can review or audit the financial statements and drill down to the underlying financial transactions and accounting records to test account balances.

What is the accounting cycle?

The three major types of financial statements – or accounting reports – are the balance sheet, income statement and cash flow statement. These statements explain a company’s financial standing and serve as an indicator of operational performance. The accounting cycle begins with a bookkeeper or accountant documenting your business’s financial transactions.

For example, if a business sells $25,000 worth of product over the year, the sales revenue ledger will have a $25,000 credit in it. This credit needs accounting cycle to be offset with a $25,000 debit to make the balance zero. Once you’ve made the necessary correcting entries, it’s time to make adjusting entries.

Preparing a Closing Trial Balance

This is the first step that takes place once the accounting period has ended and all transactions have been identified, recorded, and posted to the ledger . The first step in the accounting cycle is identifying transactions. Companies will have many transactions throughout the accounting cycle. The accounting cycle is used comprehensively through one full reporting period. Thus, staying organized throughout the process’s time frame can be a key element that helps to maintain overall efficiency. Most companies seek to analyze their performance on a monthly basis, though some may focus more heavily on quarterly or annual results.

What is the accounting cycle?

The accounting cycle is a set of steps practiced by accountants and bookkeepers to keep financial records and prepare financial statements.

As you’ve learned, account balances can be represented visually in the form of T-accounts. Is a traceable record of information that contributes to the creation of a business transaction. Activities would include paying an employee, selling products, providing a service, collecting cash, borrowing money, and issuing stock to company owners. Once the original source has been identified, the company will analyze the information to see how it influences financial records.

What are the 5 steps involved in an accounting cycle?

If there are no transactions, there won’t be anything to keep track of. Companies will have many transactions throughout their https://www.bookstime.com/. The nature of transactions may include sales, purchase of raw materials, debt payoff, acquisition of an asset, payment of any expenses etc.

First, the accountants collect, identify, and classify receipts, invoices, and other financial data. Next, the professionals read the collected data, check each transaction that occurred, and note the reasons that led to those transactions. Finally, they put it under the right label and determine their impact on different accounts based on their analysis. The accounting cycle can be simplified into an eight-step process for completing a company’s bookkeeping tasks. It provides a comprehensive guideline for recording, analyzing and reporting a business’ financial activities.

Financial and Non-Financial Transactions

Performing the accounting cycle is important for a business to understand its financial standing. It is also important for the valuation of a company and for tax reporting. Statement of cash flow – This statement shows how much money is made and spent by a company during a given time period.

- The budget cycle is an estimation of revenue and expenses over a specified period of time in the future and has not yet occurred.

- With double-entry accounting, each transaction has a debit and a credit equal to each other.

- For simplicity’s sake, we’ll start by showing you the long version of the accounting cycle, with each step broken out clearly.

- Learn how ScaleFactor can bring your accounting practices into the 21st century.

The model lets you answer “What If?” questions, easily and it is indispensable for professional risk analysis. Modeling Pro is an Excel-based app with a complete model-building tutorial and live templates for your own models. Note in the Exhibit 1 ledger extract, above, the Cash on Hand account shows a debit entry for $1200 on 6 September.